Unlocking Real Estate Potential: The Power of Joint Ventures (JV)

Introduction to Joint Ventures (JV) in Real Estate

Joint ventures, commonly referred to as JVs , hold a unique and powerful place in the real estate industry. A real estate JV is a strategic agreement between two or more parties who combine their resources, expertise, and capital to accomplish a specific real estate project, such as acquiring, developing, leasing, or selling property. Unlike traditional partnerships, each participant maintains their own identity while working collaboratively toward a shared goal. [1] [2]

How JVs Work: Structure and Key Participants

Most real estate JVs involve two main types of partners:

- Operating Partner : This party is typically responsible for sourcing, acquiring, managing, and developing the real estate project. They contribute their industry expertise and oversee day-to-day operations.

- Capital Partner : This member provides the equity or financing needed for the venture. While often passive in the day-to-day management, they retain approval or control rights over major decisions. [2] [4]

Each JV is governed by a detailed agreement outlining initial financial contributions, responsibilities, profit sharing, decision-making authority, and procedures for additional capital requirements. Structures are flexible and tailored to each project, allowing for customized arrangements. [1]

Practical Example: A JV in Action

Consider a scenario: Company X owns land in Los Angeles but is based in New York. John, a local expert, lives adjacent to the site. Company X wants to build an office block but lacks local expertise. They form a JV where Company X supplies the capital and John provides local knowledge and project management. Both parties retain their individual business identities and share profits according to their agreement. [2]

Benefits of Real Estate JVs

JVs offer several distinct advantages:

- Resource Pooling : Entities can combine financial resources and industry expertise, making it possible to take on larger projects than they could individually.

- Risk Sharing : By working together, partners distribute financial and operational risks. The specific split depends on each party’s investment and role.

- Access to New Markets : Local partners can provide market insights and regulatory knowledge, while financial partners enable expansion.

- Flexible Structures : JV agreements can be tailored to match the unique needs of each project and partnership. [1] [5]

These benefits help drive innovation, facilitate large-scale development, and empower both seasoned investors and newcomers to participate in significant real estate opportunities.

Key Considerations and Steps for Entering a JV

If you are considering joining a real estate JV, follow these actionable steps:

- Define Goals : Clearly articulate the objectives of the JV, such as acquiring, developing, or selling property.

- Identify and Vet Partners : Evaluate potential partners for complementary skills, financial stability, and industry reputation.

- Negotiate Terms : Discuss and formalize financial contributions, profit sharing, management roles, and control rights. Ensure all terms are documented in a legally binding JV agreement. [4]

- Establish Legal Structure : Work with a real estate attorney to craft an agreement that protects all parties and complies with local regulations. [5]

- Set Performance Metrics : Define how success will be measured and what reporting or oversight will be required throughout the project’s lifecycle. [3]

It is recommended to consult with a qualified real estate attorney or advisor before finalizing any JV agreement. You can find attorneys specializing in commercial real estate joint ventures by searching directories such as the American Bar Association or by contacting local law firms with real estate expertise. For example, Lipresti Law is one such firm, but users should search for “commercial real estate attorney” in their region for options. [5]

Challenges and Solutions in JV Arrangements

While JVs offer significant opportunities, challenges may arise:

- Alignment of Interests : Disputes can occur when partners have differing priorities. Regular communication and clear contractual terms can mitigate this.

- Capital Calls and Dilution : If additional funding is needed, partners must agree on how contributions affect ownership shares. [4]

- Decision-Making Authority : Establishing who controls major decisions is critical. Agreements should specify approval processes and conflict resolution methods.

- Exit Strategies : Partners should plan for how to handle asset sales or dissolution of the JV, including buyout terms and conditions.

To address these challenges, regularly review the JV agreement, maintain open lines of communication, and update terms as needed to reflect changing circumstances.

Alternative Approaches to JVs

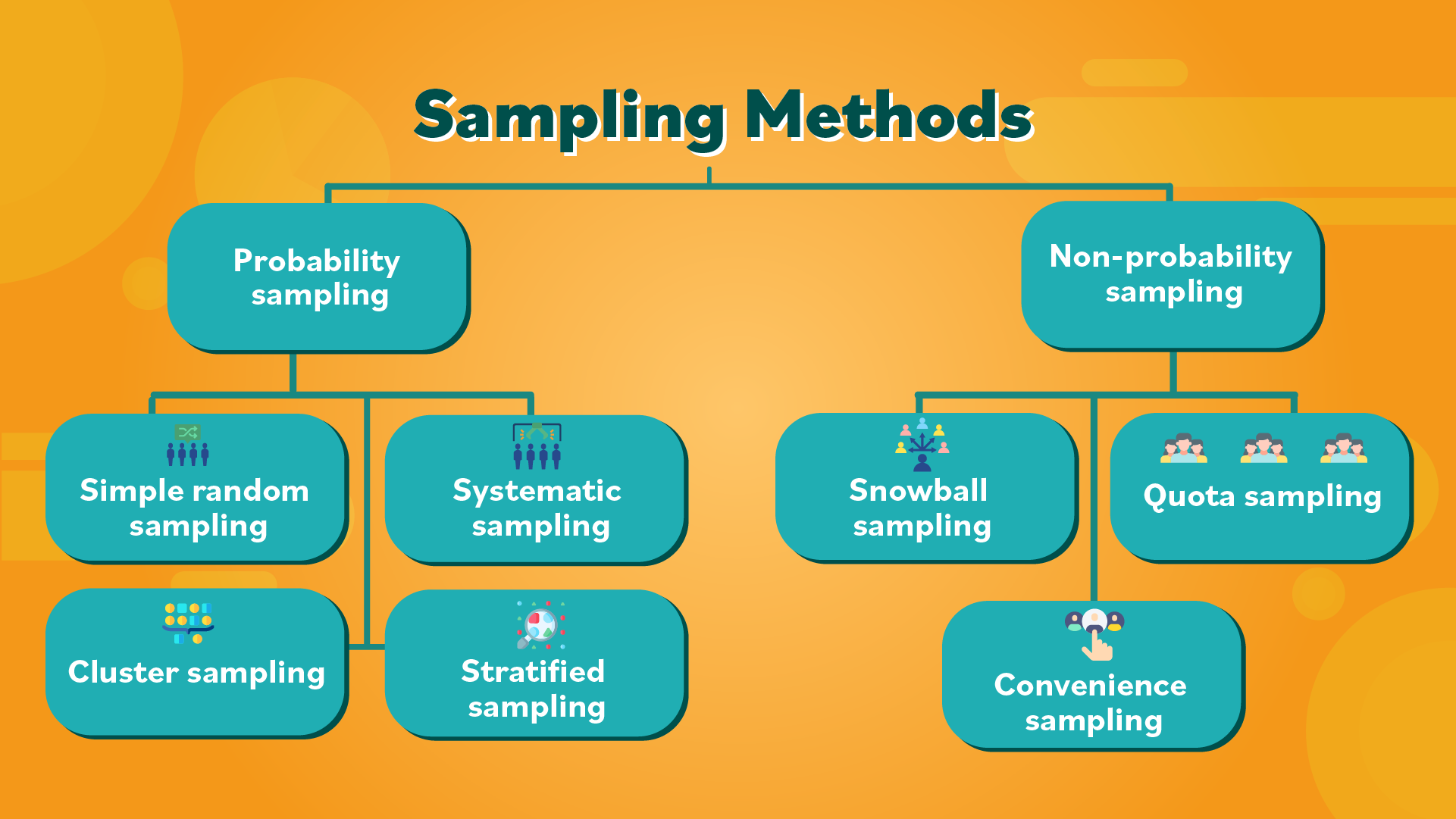

JVs are one of several ways to collaboratively invest in real estate. Alternatives include:

- Traditional Partnerships : Unlike JVs, this creates a new, distinct legal entity owned by the partners.

- REITs (Real Estate Investment Trusts) : These publicly traded companies allow investors to pool resources without direct management responsibilities.

- Syndications : In this model, a sponsor pools funds from multiple passive investors to acquire or manage real estate assets.

Each approach has unique advantages and drawbacks. Consider your investment goals, risk tolerance, and desired level of involvement when choosing the appropriate structure.

How to Find and Access JV Opportunities

To identify JV opportunities in real estate:

Source: dealroom.net

- Network with real estate professionals at local and national industry events.

- Consult with commercial real estate attorneys who can facilitate introductions and advise on legal arrangements.

- Search online platforms specializing in real estate investment opportunities, such as established brokerage firms’ websites. Always verify the legitimacy of any platform before engaging.

For actionable steps: Identify your strengths-capital, expertise, or market access-and seek partners who complement your capabilities. Initiate contact via professional associations, LinkedIn, or reputable brokerage firms. When approaching law firms or investment groups, request references and case studies of previous JV projects to assess their experience.

Summary and Key Takeaways

Joint ventures in real estate empower investors and developers to tackle larger, more complex projects by pooling resources and sharing risks. Success depends on clear agreements, aligned interests, and proactive management. Before entering a JV, consult with qualified professionals and conduct thorough due diligence. For step-by-step guidance, start by defining your goals, vetting partners, and seeking legal counsel to ensure your interests are protected throughout the venture. [1] [2]

Source: bajajfinservhealth.in

References

- [1] Clopton Capital (2024). Joint Venture Real Estate: Combining Resources and Sharing Risk.

- [2] Corporate Finance Institute (2024). Real Estate Joint Venture (JV) – Overview, Structure and Key Aspects.

- [3] Enterstate Capital (2023). Key Factors Contributing to Successful Joint Ventures in Real Estate.

- [4] Bradley (2023). Key Terms of Real Estate Joint Venture Agreements.

- [5] Lipresti Law. Joint Ventures in Commercial Real Estate.

MORE FROM couponito.com